About Us

High Quality Tactical Solutions

Finding A Permanent Solution Is Our Ultimate Goal!

Since 1995, Our Team Has Succeeded In Understanding The Needs Of The Clients And Creating Reliable Advices To Serve Them All.

“I believe that the biggest mistake that most people make when it comes to their retirement is they do not plan for it. They take the same route as Alice in the story from “Alice in Wonderland,” in which the cat tells Alice that surely, she will get somewhere as long as she walks long enough. It may not be exactly where you wanted to get to, but you certainly get somewhere.”

― Mark Singer, The Changing Landscape of Retirement – What You Don’t Know Could Hurt You

We are here to help our client with the best possible solution

Some Cool Facts

Numbers Speak For Themselves

Quality Comes First! We Make Sure That Every Minute Detail Is Looked Into While Planning Even For The Smallest Needs. Our Focus Is 100% On Client Needs And Satisfaction.

Innovative Solutions

“Stress and worry, they solve nothing. What they do is block creativity. You are not even able to think about the solutions. Every problem has a solution.”

Susan L. Taylor

We Are The Creators You Can Trust On For A Perfect Solution To All Your Needs.

Our mission

We are committed to maintaining the highest standards of integrity and professionalism in our relationship with you, our client. We endeavor to know and understand your financial situation and provide you with the highest quality information, services, and products to help you reach your goals.

Our Vision

As we listen to you, we learn about your objectives, your perspective on risk and your liquidity needs. We then devise a plan to support your personal goals through professional investment management and strategic planning.

Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation.

Using the details you have confided in us and our access to quality research and analysis, we narrow down a selection of investments and an allocation tailored to your financial objectives. We will then present our recommendations and outline the steps needed to implement your plan.

Once you have approved the plan, we put it into action by choosing investment vehicle types and services customized to your needs, goals and risk tolerance. We craft your portfolio carefully, making the most of the choices available to serve your precise situation.

After establishing your plan, we review its progress toward your objectives and strive to ensure it keeps working for you through all of life’s changes, updating you and providing support as needed. We stay abreast of what’s ahead, helping you remain equipped for the challenges of tomorrow.

Our Values

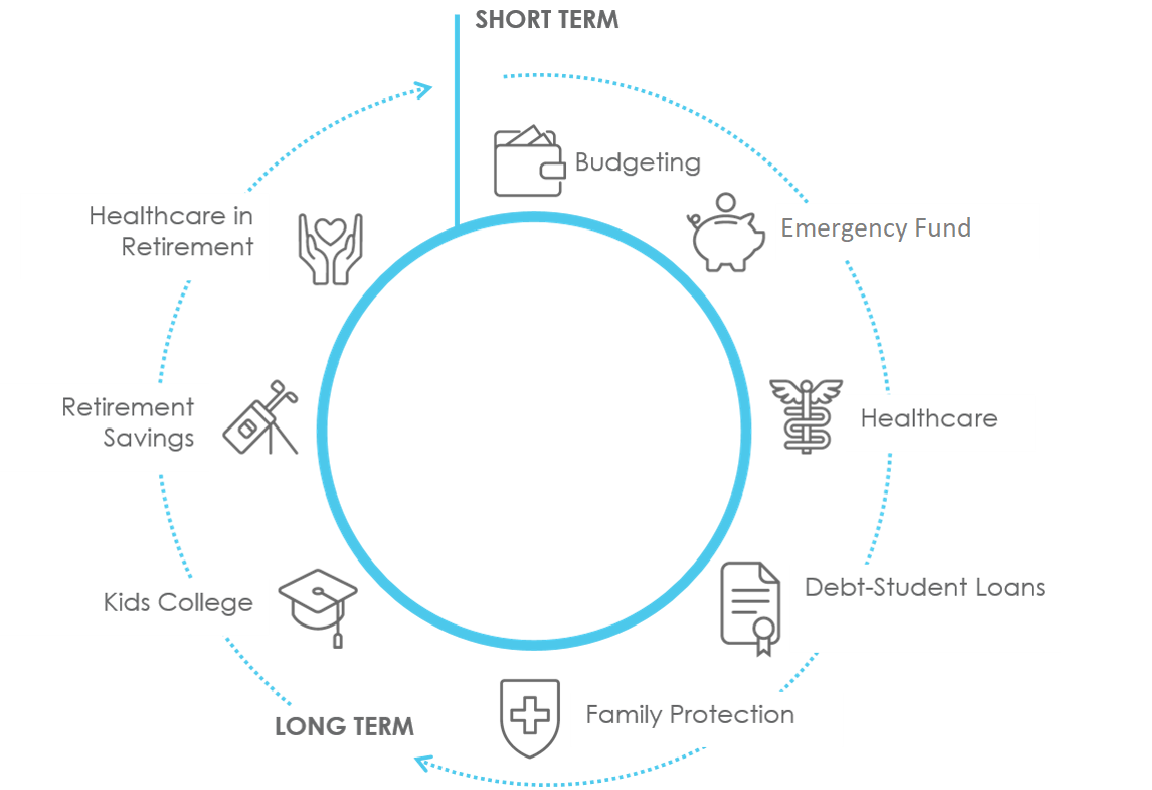

Financial Planning

This is when establishing future financial and education plans should be at the forefront. While your income will most likely be low during this period, time is on your side. Setting and adhering to established financial goals will have a big impact on what you will have accumulated later in life.

For most, these are the prime spending years when homeownership and family expenses and other things put a strain on their bank balance leaving them wondering if there will ever be enough money to go around.

The best thing to do is to review and consider your accumulated responsibilities, towards your family’s welfare and whether you have enough to fulfill your goals.

At this stage, your focus shifts from spending to saving and investment. Expenses become fewer as children grow up. Outstanding home ownership balances become manageable. You have a few more years to be active so you can add up your retirement contributions to at least 15 percent or 20 percent or more, of your income.

This age bracket indicates you are at the peak of your career and looking towards impending retirement. This is also the time to consider what your pension and retirement income will be against future expenses. Such a review will help you identify any shortfalls and take corrective action if possible, being prepared makes the retirement transition much easier. Reduce the overall risk of your portfolio. You may be in a transition stage as you move from employment to retirement and your investments may need to be geared more towards guaranteed returns like interest-bearing investments funds such as the Savings Plan and the Guaranteed Personal Pension Plan, and less towards growth geared funds.

Financially, the biggest headache for retirees is how to continue getting an income in retirement. It will not be a headache if you have been saving for retirement. You can put your pension fund in an Income Drawdown Plan and you will receive a fixed income every month. What’s great about this Plan is that the lump sum you deposit will still be available to you at the end of the contract.

Money Management Process

How We Are Different

Personalisation

In addition to improvements in revenue, personalization in banking can enable a number of benefits including:

- Increases in engagement and conversion rates

- Improved customer loyalty and retention

- Enhanced customer experience

- Consistent messaging across channels

- Stronger marketing ROI

Customisation

Users are asked to identify their preferences and they are then shown things that they prefer. For example, when customers sign up for Netflix, the service asks users to select a few shows they like and then displays a list of options based on those choices.

Virtual Advisory Planning

Virtual Financial Advisors. Traditional financial advisors usually engage with clients face-to-face, whereas virtual financial advisors communicate through video calls, over-the-phone and by email.